Update on Current Monetary Conditions and Future Prospects

Acknowledge dignitaries and organizers (CIMC) of the forum.

I would like to thank the CIMC for the invitation to speak today.

The theme of this forum is very appropriate and timely – “Implementing sustainable development plans: building from past experiences for a better PNG”. The theme is appropriate because implementing sustainable development plans is necessary to ensure we achieve inclusive and sustainable growth in PNG. I have been tasked to provide an update on current monetary conditions and future prospects.

To begin, PNG has never been at a more favourable state in the 40 years since gaining political independence. While the global economy recovers, we continue to experience economic growth for the 14th year in a row. Not only has the mineral sector continue to perform well with global demand for our minerals remaining high, but our non-mineral section remains resilience despite low international commodity prices. Real GDP is forecasted to grow by 15 percent this year and by 5 percent in 2016. GDP growth in 2015 reflects the full year production of LNG, full capacity production of nickel and cobalt and increased production in the non-mineral sector.

Our financial system remains sound and is prudently managed. It is adequate for our stage of development with four commercial banks, eight financial institutions (finance companies and merchant banks), four micro-banks, twenty-two savings and loan societies, three large superannuation funds and several life and general insurance companies. We also have a stock exchange for the capital market. Our financial system has supported economic growth in the past and will do so in the coming years. Total assets of our financial system stands at over K40 billion as at end March 2015. However, only about 20 percent of the total population has access and use of the formal financial system.

The Government’s expansionary fiscal policy for three years in a row has supported economic growth following the end of the LNG construction phase. Increased spending in key priority areas like infrastructure, agriculture, education and health will not only ensure economic growth is sustained but improve the living standards of our people. We commend the Government for targeting these priority areas.

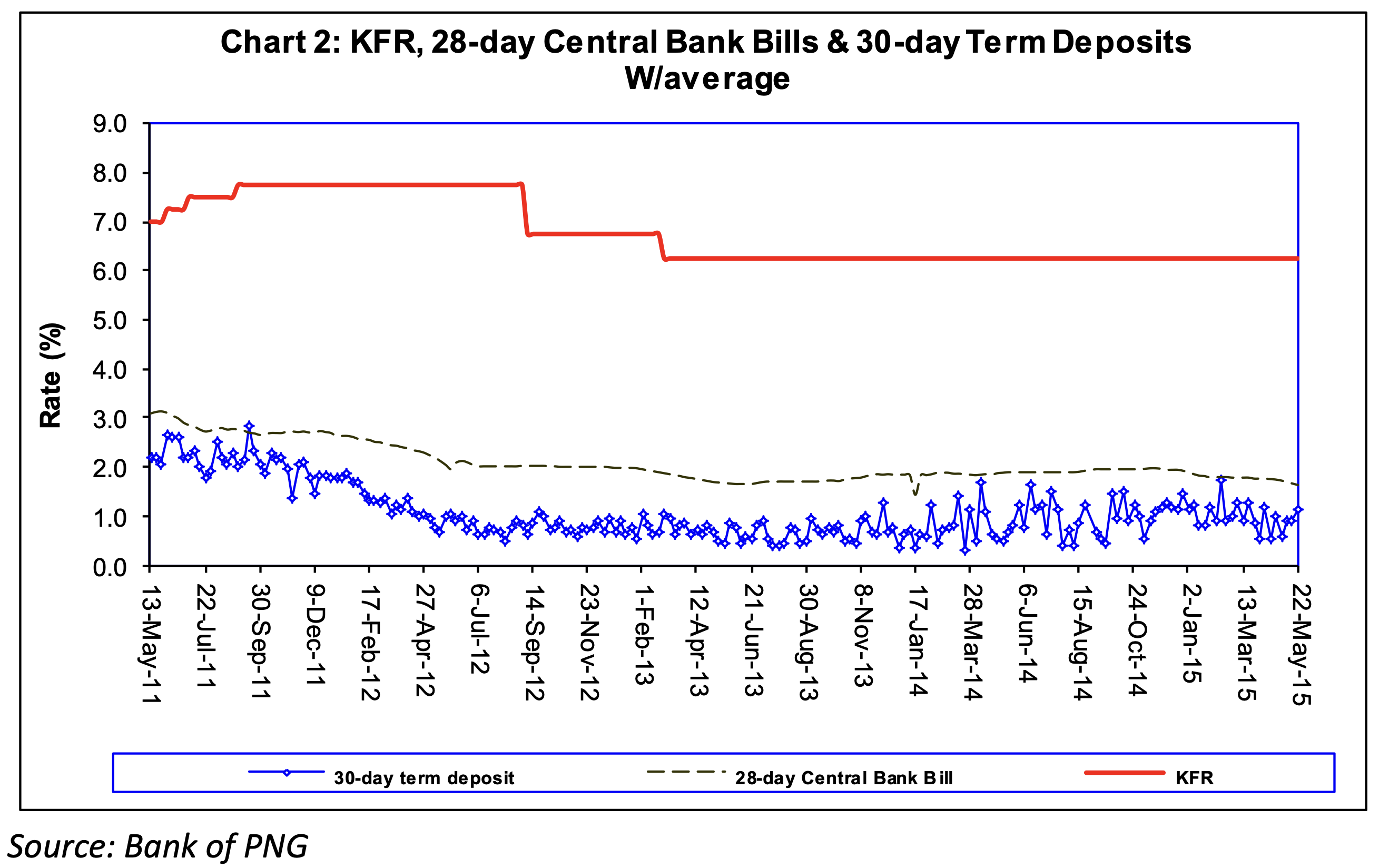

Financing the Government budget from domestic sources was a challenge. This resulted in higher interest rates on Treasury bills in 2014. In September 2014, the Central Bank and the Government agreed on a temporary six-month arrangement for the Central Bank to take up the slack or under subscription in the Government securities auctions and on-sell them to the market. This arrangement ended in March 2015 and stabilized the interest rates at between 4 percent (182 days) and 7 percent (364 days). The fast increase in interest rates for Government papers prior to September 2014 was not necessary, given the excess liquidity in the banking system.

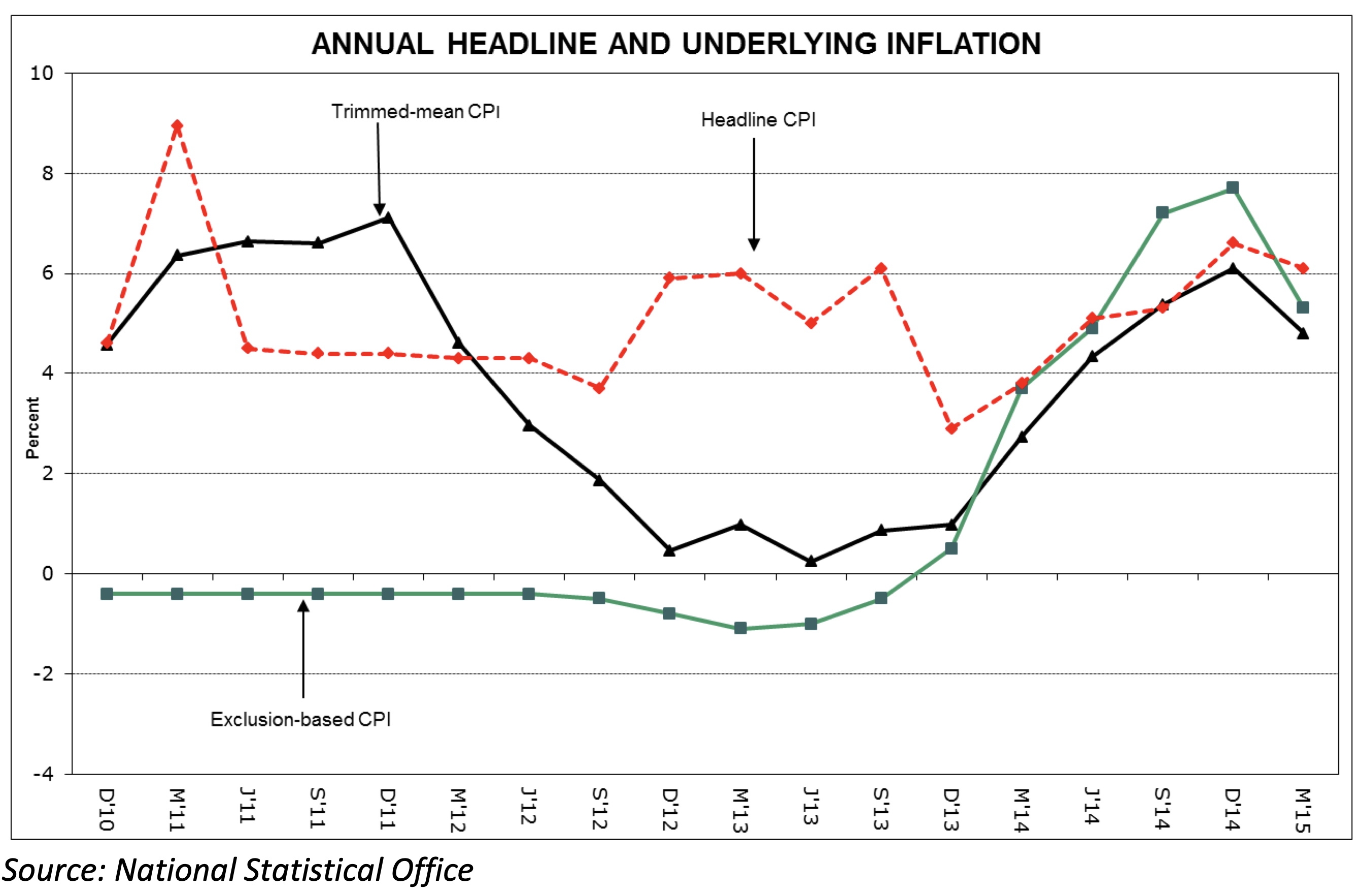

The good news is that the high economic growth has not translated into high inflation outcomes. We have succeeded in ensuring inflation remained low due to both domestic factors and low imported inflation. The new Consumer Price Index (CPI) basket (by the National Statistical Office) indicated a headline inflation of 6.1 percent for the March quarter of 2015, compared to 6.6 percent in the December quarter of 2014.

The increase in aggregate demand associated with the increase in economic growth, combined with higher public sector spending from the record Government budgets and the depreciation of the kina led to an increase in the prices of goods and services.

While economic growth is good, there is some tradeoff between that outcome and inflation. Inflationary pressures should be expected in this period of high economic growth.

Price monitored items need to be looked at. For instance, the benefits of recent declines in international crude oil prices have not been passed by business houses onto the prices of other goods and services. These were complicated in subsequent months by increases in fuel prices announced by the ICCC. There should be a process of effecting changes in fuel prices to ensure some adjustments to prices of other goods and services are made by business houses before further announcements on fuel prices are made.

There is a liquidity over-hang in our banking system due mainly to the on-going large Government expenditures. The overall liquidity in the banking system amounted to around K8 billion as at 19th June 2015. The Central Bank uses the trade in Central Bank Bills (CBBs) and Government securities (Treasury bills) for its open market operations to diffuse some of this high liquidity levels. As at 19th June 2015, we have on issue to the market K2.5 billion worth of CBBs. Domestic liquidity conditions may be exacerbated when inflows from the LNG project commences. It is therefore important that the Government gets the Sovereign Wealth Fund operational to mitigate the effects of the flows on macroeconomic stability and help minimize the effects of the so-called Dutch

Disease on the non-mineral sector. Parking the funds in Government trust accounts as was done in the past is not the recommended approach.

There is sufficient liquidity in the banking system to support continued economic activity through lending for investment.

It is also important that the Government develop the agriculture sector where the majority of our population is based in. This would not only expand the export base of the economy but also the revenue base for the Government. Introducing advanced technologies and innovative systems in our agricultural sector would assist the country deal with the so-called Dutch Disease as a result of the development of our non-renewable industries.

The high liquidity in the banking system has resulted in the current low interest rate environment. As at 19th June 2015, interest rates on Central bank bills ranged between 1.4 percent (28 days) to 2.6 percent (91 days), and for Treasury bills from 4.4 (182 days) to 7.1 percent (360 days). Commercial bank deposit rates ranged between 1.25 percent (30 days) and 1.5 percent (180 days).

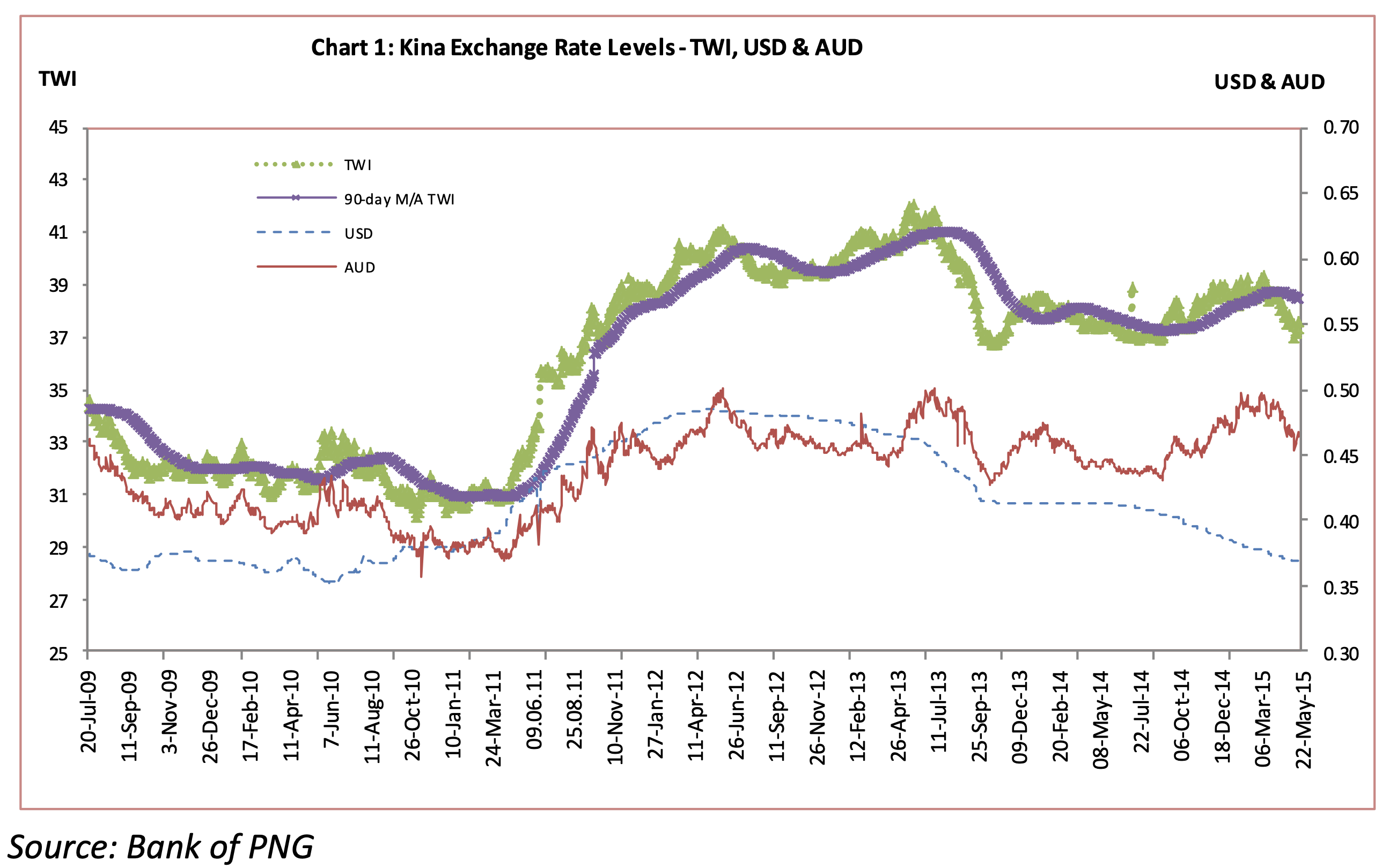

The high liquidity levels also contributed to the increased import demand in the foreign exchange market. Coupled with reduced foreign exchange inflows, this has exerted downward pressure on the kina exchange rate. The kina has depreciated by 5 percent against the US dollar and by 0.4 percent against the Australian dollar between the end of December 2014 and 19th June 2015. With the continued high import demand, the kina is continuing to depreciate, and is at present at a mid-rate of US 36.45 cents to the kina.

Recently, the Central Bank introduced several measures to restore order in the foreign exchange market. In October and December 2013, forward orders were restricted from the inter-bank market. This stabilized the exchange rate at US$0.4130 for nine months (up to May 2014) as shown in Chart 1. Banks however traded away from the inter-bank exchange rate, resulting in a market failure and loss of price making by the authorized foreign exchange dealers. The Central Bank therefore imposed an exchange rate trading band around the inter-bank rate in June 2014.

The new trading band improves the transparency of the price making process in the market for both the authorised foreign exchange dealers and their customers.

We still maintained a floating exchange rate regime despite the misunderstanding by various commentators that we have adopted a fixed exchange rate system. The exchange rate movements reflect market fundamentals, based on the supply of and demand for foreign currency, as seen in chart 1 below.

The Central Bank intervened in the foreign exchange market to support the excess demand for foreign currency and smooth the depreciation of the exchange rate. In the first half of this year (January to June 2015), we intervened by US$382 million, equivalent to K1,011 million. As at 19th June 2015, our international reserves stood at US$2 billion (K5.5 billion), sufficient for 8.7 months of total and 13.5 months of non-mineral import cover.

While we have sufficient foreign exchange reserves, various practices in the foreign exchange market led to us announce several foreign exchange control directives in March this year. Unauthorised foreign banks were undertaking banking business in PNG by accepting deposits and making payments to residents, restricting foreign exchange inflows to the authorised foreign exchange dealers. We have also introduced the three months retention period to ensure our export proceeds are brought back onshore and tightened up on the operations of foreign currency accounts by residents. The new directives do not change the foreign exchange control regime but were done in line with the Foreign Exchange Control Manual.

These measures, together with the trading band introduced in June 2014 were meant to restore order and ensure a smooth functioning of the foreign exchange market.

With low inflation outcomes and the favourable macroeconomic conditions, the Bank of Papua New Guinea has maintained an accommodative monetary policy stance to support the expansionary fiscal policy support economic activity and growth. The policy signaling rate, the Kina Facility Rate (KFR) was maintained at 6.25 percent since March 2013.

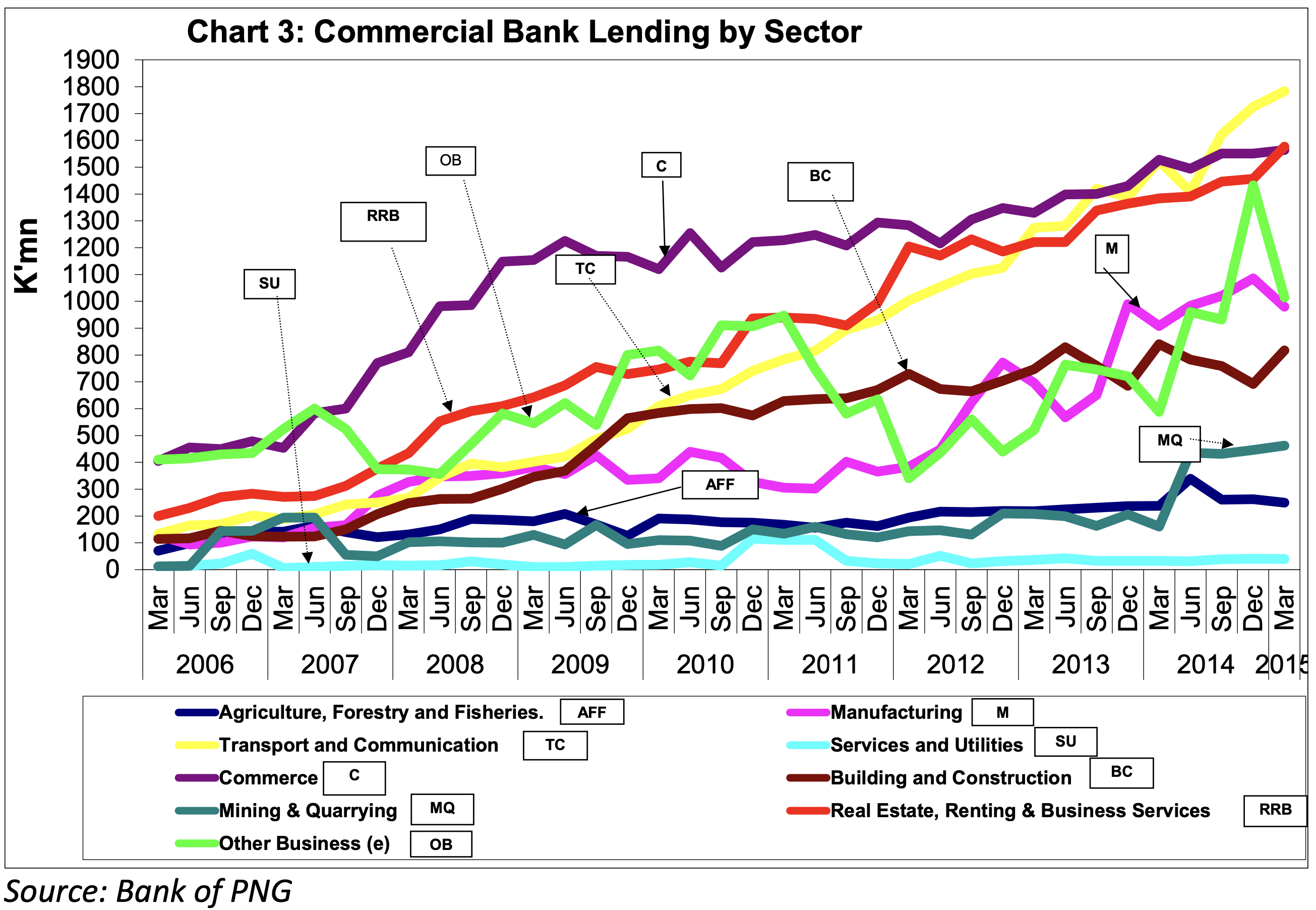

The current stance of monetary policy is conducive to promoting economic activity. There is increased commercial bank lending, mainly in the commerce, transportation, manufacturing and real estate/housing sectors. This is encouraging especially now that the construction phase of the LNG project is over and business entities returned to utilizing lending from the banks (see Chart 3).

There is sufficient liquidity in the banking system to fund both the Government’s financing needs and that of the private sector.

Monetary policy management was aimed at finding a balance between high liquidity levels, rising interest rates from budget financing, and high import demand. We caution last year on the high expectation of LNG revenue and in the first half of 2015, LNG revenue were much lower, further aggravated by low oil and other commodity export prices.

During recent years and going forward, the Bank has taken initiatives continuously to further enhance the structure of the financial system, to facilitate more effective intermediation and to improve the risk management practices.

To empower our people financially to fight poverty, we have undertaken various financial inclusion initiatives. We have embarked on a program of getting every Papua New Guineans access to banking and financial services.

Our licensed financial institutions have rolled out various products and services to enable wider participation in the financial industry. The telephony companies have also introduced products and services that are benefitting a lot of our people. We have held a number of Financial Inclusion Expositions to showcase these products to the public around the country - in Lae, Port Moresby, Kokopo, Alotau, Goroka and Madang. The next expos, for this year, are planned for Mt. Hagen and Wewak to coincide with the Provincial cultural shows. We also launched the PNG National Financial Inclusion & Financial Literacy Strategy 2014-2015. This strategy targets the opening of 1 million bank accounts over the next 2 years with 50 percent as women.

Another project we are working on is the National Payments System, which was launched in March 2014. This new payment system (called KATS) has real time gross settlement for inter-bank payments. We have also launched the automated cheque clearing process, known as cheque truncation. Our domestic payment system is now on par with our international payment system, ensuring a more safer, cost effective and reliable payment system. In recent media reports, the KATS has revealed fraudulent payment activities. This is evidence of the benefit of KATS.

To conclude, the Central Bank will aim to ensure its policies and initiatives support the Government’s sustainable development plans. I am mindful of the expansionary fiscal policy and potential inflationary pressure that this could cause. We will continue to be cautious and may adjust our stance of monetary policy if developments in the economy and/or financial market warrant it.

Thank you.